Danske Hypotek AB

Danske Hypotek is a wholly owned Swedish subsidiary of Danske Bank A/S. In the middle of 2017 the company received permissions from the Swedish Financial Supervisory Authority to conduct business as a credit market company and to issue covered bonds.

The primary purpose of the company is to create long-term stable financing with regard to Swedish mortgage loans. The Swedish branch’s long-term growth in Sweden is supported through the company’s access to the Swedish benchmark market for covered bonds. This way, the best possible conditions are created for the Swedish branch to offer long-term competitive lending to Swedish mortgage loan customers and owners of residential properties in Sweden.

Danske Hypotek acquires Swedish mortgages from Danske Bank A/S, which are secured by Swedish real property (fastigheter), site leasehold rights (tomträtter), tenant-owner rights (bostadsrätter) and multi-family houses (flerfamiljshus) and funds these assets with the continuous issuance of covered bonds, primarily in the Swedish benchmark-market. The acquired mortgages are included in the company’s Cover Pool and comply fully or in part with the requirements under the Covered Bonds Act. The company may also hold Supplemental Assets, and Public Credits can be used as supplemental security in accordance with the Covered Bonds Act.

For more information on the Swedish Covered Bonds ActOrganisation and governance

Danske Hypotek has employed key personnel including the Chief Executive Officer and staff within the functions Operations & IT, Credit, Economy & Finance and Treasury. Danske Hypotek has entered into service orders with Danske Bank A/S, e.g. in relation to IT- and credit administration services. The functions for Compliance, Risk, Audit, Business Risk & Control and Legal are outsourced to Danske Bank A/S, although accountability (responsibility) resides with Danske Hypotek. The Chief Risk Officer (CRO) and Head of Compliance represent the 2nd line of defense, while Internal Audit represents the 3rd line of defense. The Risk and Compliance functions provide oversight over the 1st line and challenge the execution of their risk management practices. Risk and Compliance are also responsible for reporting risks directly to the Board of Directors. Internal Audit support the Board of Directors through monitoring all parts of the organization, including the control functions.

The senior management of Danske Hypotek consists of Per Tunestam, Chief Executive Officer, Peter Jönsson, Chief Financial Officer, Joakim Olsson, Head of Credit, Malin Hägglund, Chief Operating Officer, Tomas Renger and Jonas Wikfeldt, Chief Funding Managers, Romina Bolin, Head of Legal, Mathilda Ludwigs, Senior Legal Counsel, Maria Hagel, Senior Business Operational Risk Officer, Robert Höglund, Head of Compliance and Anneli Virdenäs, Chief Risk Officer.

Danske Hypotek has established a Risk Committee to ensure follow up and review of compliance with the company’s risk management and control framework. The ordinary members of the Risk Committee are the Chief Executive Officer (chair), Chief Financial Officer, Head of Treasury and Chief Operating Officer. The functions for Risk and Compliance are non-decision making observers with a right to veto decisions.

The Board of Directors appoints the Chief Executive Officer and is ultimately responsible for the company’s operations, including the outsourced functions, being conducted appropriately and in alignment with laws and regulations. The Board of Directors is responsible for long term decisions around strategic goals, risk strategies and internal governance. Danske Hypotek has a minimum of four ordinary Board meetings annually, in addition to the statutory Board meeting.

Board of Directors and Chief Executive Officer competence

The Danske Hypotek Board of Directors and the Chief Executive Officer comply with the requirements laid down in Chapter 3 Section 2 Point 4 of the Banking and Financing Business Act (2004:297).

The Board of Directors consists of five board members, whereof four hold senior positions within the Danske Bank Group and are collectively experienced in terms of financing (including the Swedish mortgage loan market), financial and non-financial risks, regulatory frameworks and the Danske Bank Group business models and strategies. The external Board member has experience from senior roles in the Swedish financial industry. The Board of Directors holds a suitable spread of knowledge and experience in relevant areas and continuously updates and deepens its knowledge in identified relevant subjects which are documented in the annual Board of Directors training plan.

The Chief Executive Officer has worked in senior roles within the financing area in the Swedish financial industry and therefore has competence in relation to financing, funding and capital structure.

Chief Executive Officer:

Per Tunestam

Title: CEO, Danske Hypotek

The Board of Directors:

Nicklas Ilebrand

Board assignment: Chairman of the Board of Directors

Title: Head of Personal Banking SE

Jacob Carlstedt

Board assignment: Board member

Title: Head of Personal Denmark & Private Wealth Management Credit, Danske Bank A/S

Kim Borau

Board assignment: Board member and responsible for accounting matters

Title: Head of Performance Management, Personal and Business Customers, Danske Bank A/S

Kamilla Hammerich Skytte

Board assignment: Board member

Title: CEO, Realkredit Denmark A/S

Justin Fox

Board assignment: Board member

Title: Group Treasurer

Kristian Bentzer

Board assignment: External Board member

Danske Bank A/S, Swedish Branch

The history of Danske Bank’s operations in Sweden dates back to 1997 and today the bank is the fifth-largest in the country. With 1,500 employees the bank serves personal and business customers and large institutional clients from local branches and regional finance centres, as well as via various digital channels. Danske Bank in Sweden has a strong commitment to continue attracting new customers through strategic partnerships with organizations like Saco and TCO which comprises 22 and 14 unions with more than 2 million union members, and HSB – a cooperative savings and construction association with 674,000 members.

Danske Bank A/S

The Issuer forms part of the Danske Bank Group. The parent company of the Group is the Parent. The Parent was founded in Denmark and registered on 5 October 1871 and has, through the years, merged with a number of financial institutions. The Parent is a commercial bank with limited liability and carries on business under the Danish Financial Business Act. The Parent is registered with the Danish Business Authority and is under the supervision of the Danish Financial Supervisory Authority . The registered office of the Parent is at Bernstorffsgade 40, 1577 Copenhagen V, Denmark, with telephone number +45 33 44 00 00 and Danish corporate registration number 61126228.

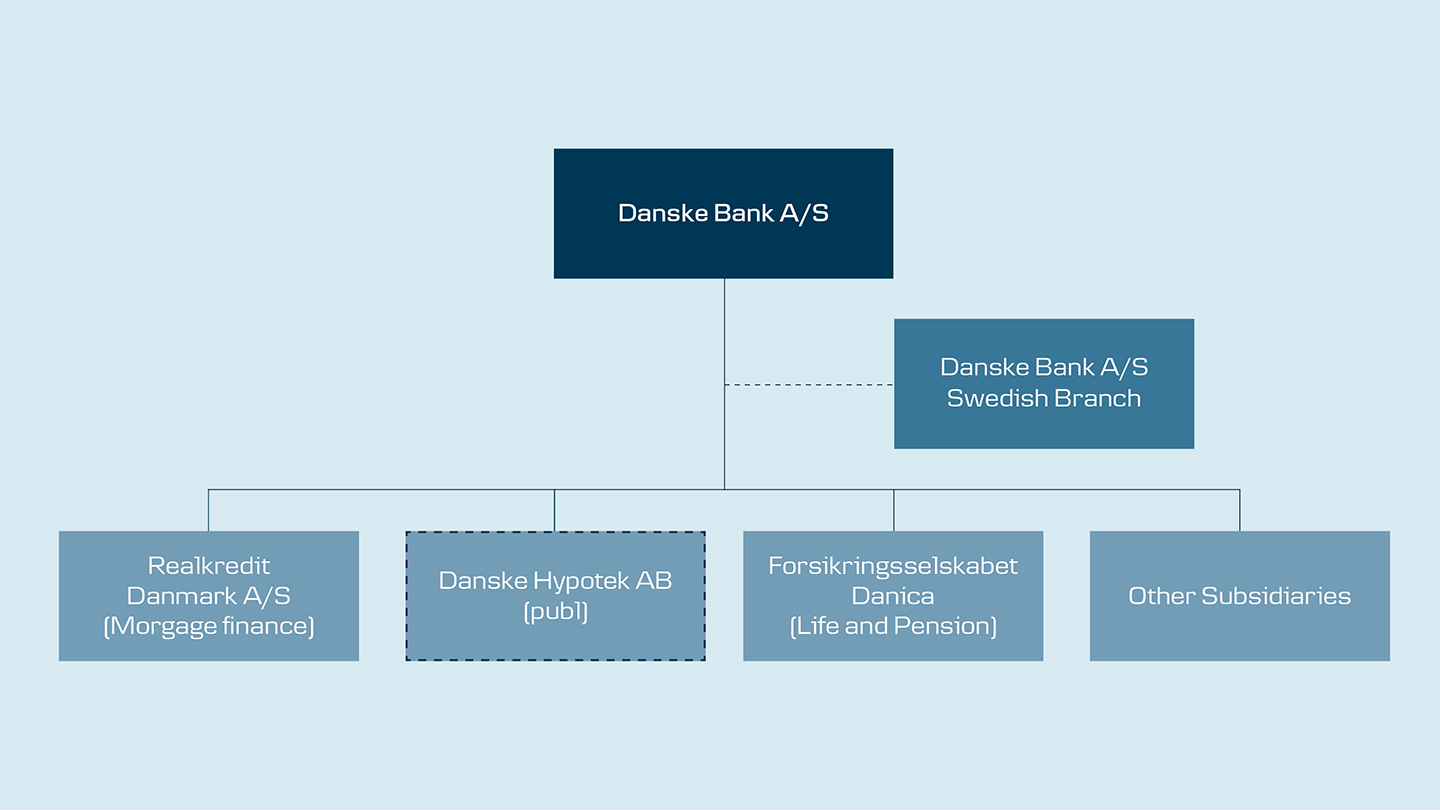

The Parent is conducting its lending operations in Sweden through the Swedish Branch. The structure of the Group is set out in the structure chart below.

The Group is the leading financial service provider in Denmark, and the group also has significant operations in its other main markets, Sweden, Norway and Finland. The Danske Bank Group is one of the largest financial service providers in the Nordic region. The Group offers customers a wide range of services in the fields of banking, mortgage finance, insurance, pension, real-estate brokerage, asset management and trading in fixed income products, foreign exchange and equities.

For more information on Danske Bank group